BusinessWeek has today's news:

BusinessWeek has today's news:Oil prices fell below $69 a barrel Wednesday after government data showed the domestic supply of gasoline rising for the third straight week amid stagnating demand.The reason: projected demand for the rest of 2006 has dropped, and OPEC has announced that supply will have increased by the end of the year. But if the last few months have taught us anything about oil markets, it's that nothing's for certain. Says Brad Foss of BusinessWeek [emphasis mine]:

... But oil prices are still about 40 percent higher than a year ago amid persistent market anxieties about the West's nuclear standoff with Iran, supply disruptions in Nigeria and the upcoming Gulf of Mexico hurricane season.

More excess capacity would be good, of course. But who would want to significantly augment supply when it's a supplier's market? And will things really get worked out with Iran with Bush at the helm? Stay tuned.OPEC also sought to dampen concerns about its surplus production capacity. When this excess capacity is tight, it makes oil traders extra jittery about any real or potential threats to supply. From the end of 2002 to the end of 2005, OPEC said its spare production capacity declined from 5 million barrels per day to 2 million barrels per day. But the cartel said that figure would rise to 3 million barrels per day, or 3.5 percent of global demand, by the end of this year, thanks to the combined effects of weakening demand growth and new projects coming on line.

Despite OPEC's claims, many analysts point out that the bulk of this excess capacity resides in Saudi Arabia and is not the high-quality crude oil that is preferred by refiners.

Moreover, the market remains fixated on geopolitical factors that are beyond the control of OPEC, such as violence in Nigeria and the diplomatic dispute between the West and Iran over Tehran's nuclear ambitions.

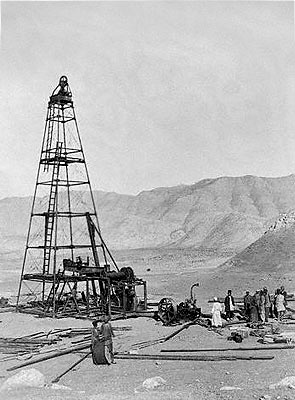

(Image from PBS of an oil derrick in 1909 Persia)

No comments:

Post a Comment